Transfer to Title

Transfer to Title Downloads

Receipt of the Title Deeds

Uniquely, Purchasers receive full Title to the Land they have purchased. Title Deeds are passed to the new Owner upon the Developer obtaining:

- the Certificate of Compliance in respect of the subdivision permit for works completed and regulatory payments made,

- receipt of the necessary certificates from affected regulatory bodies, including ZIMRA

- full receipt of the purchase price and

- settlement of all transfer and conveyancing related fees, levies and taxes, by the Purchaser

Conveyancing

The conveyancer prepares the draft deed, power of attorney to pass transfer as well as declarations for signing by buyer and seller. The authority to draft as such is derived from the signed and witnessed Sale Agreement and in drafting reference is made to the Seller’s Original Title Deed, the diagram deed thereto annexed and the new subdivision permit and Surveyor Generals Dispensation Certificate and diagram.

Conveyancing Fees

The Conveyancing Fees are determined and regulated by the Law Society of Zimbabwe by-laws S.I. 24/2013 with effect from 1 March 2013 and are based in the purchase price of the Stand, including VAT as follows:

Minimum of $400 on first $10,000 or less

4% on the next US$ 10,000 – US$250,000

3% on next US$250,000 – US$500,000

2% on next US$500,000 – US$1,000,000

1% on next $1,000,000 and above.

VAT is chargeable on Conveyancing Fees

Conveyancers may also recover reasonable disbursement costs.

Developers Conveyancers

The appointed conveyancers are Manokore Attorneys, whose Real Estate and Property Development practice offers specialised expertise to a wide range of clientele from developers and property investors, to corporates and individuals.

They may be contacted on legal@arlingtonzw.com or www.manokore.com

Capital Gains Clearance Certificate

A Capital Gains Tax (“CGT”) Clearance Certificate is required to be received from Zimbabwe Revenue Authority (“ZIMRA”), in order for the Registrar to complete Transfer to Title

As a registered property developer with ZIMRA the Developer is authorised and required to levy Value Added Tax (“VAT”) on the sale of Stands. It is on the payment of such VAT, that the CGT Clearance Certificate is sought.

Application for such is made on the parties’ behalf by the Conveyancers. Both the Purchaser and the Seller are required to attend an interview at the Offices of ZIMRA at Ground Floor, Kurima House, corner Nelson Mandela Avenue and 4th Street, Harare.

Documents required to be presented by the Purchaser are as follows:

- Original Sale Agreement

- Original Proof of Payment

In the case of an INDIVIDUAL

- Certified Copy of Identification document – not a driver’s license

- Special Power of Attorney (if required as advised by the Conveyancer)

In the case of a COMPANY

- Certificate of Incorporation

- CR14 – particulars of Register of Directors and Secretaries

- CR 6 – notice of situation and postal address of the Company’s Registered Office

- Directors’ Resolution to appoint a representative of the company in the transfer process

- Directors’ Resolution to authorise purchase (must be signed by all directors and Public Officer or Company Secretary

- Certified copy of Identification document of the appointed representative (not a drivers license)

In the case of a TRUST

- Original Trust Deed

- Resolution to appoint a representative of the Trust in the transfer process

- Trustees’ resolution to authorise purchase (must be signed by 2 Trustees )

- Agreement of Sale

- Certified copy of Identification document of the appointed representative (not a drivers license)

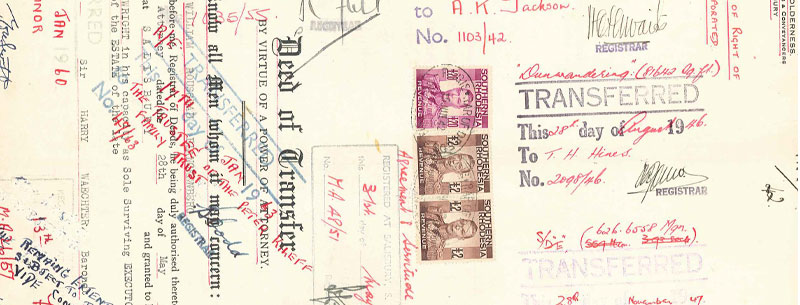

Registrar of Deeds

Transfer documents are lodged for registration of title with the Registrar of Deeds Office. This office levies a Stamp Duty fee for examination of the deeds and if necessary will perform an independent valuation and onsite inspection of the property.

Upon signature and registration of the deed, one copy of the deed is filed in the Office of the Registrar and the second copy returned to the conveyancer for onward transmission to the purchaser.

Stamp Duty

Stamp duty is payable upon lodging of the registration of title with the Registrar of the Deeds Office and the levying of such is governed by the Finance Bill 2009. Is it calculated on purchase price including VAT.

Registration fee US $20

1% for first US $5,000

2% on next US $15,000

3% on the next US$ 80,000

4% on US$ 100,000 and above

Rates Clearance Certificates

Rates are levied based on the value of the property, size and improvements thereto.

Purchasers are liable for Rates from the Signature Date of their sale agreement, being the date on which they thereby assume their rights and obligations thereover. Typically the Signature Date is the date on which the full purchase deposit is received into the designated Trust Account of the Developer’s Conveyancers.

In preparation of the registration of transfer, the conveyancer will apply for a rates clearance certificate from the City of Harare. Such certificates require that Rates be pre-paid for a minimum of 3 months and the Conveyancer will accordingly advise the new owner of the amounts to be paid.

Survey General Deduction Fee

Section 22 of the Deed Registry Act, Chapter 20.05 stipulates interalia that “…Where a dispensation certificate has been issued in respect of any land, no subdivision of the land and no registration over that land or a real right which is defined on a diagram shall be registered unless a diagram of the land is annexed to the title of the land.”

However, where the Developer who has already obtained Dispensation Certificates for the land, the Surveyor General’s office will not require each new Title Deed to have a diagram attached. Instead, the Title Deed will be stamped by the Surveyor General’s office to indicate that an individual Stand diagram will be available on application.

The stamp fee is called the Deduction fee and is payable by the Purchaser.

Ideally, this process takes 4-6 weeks from date of submission to the Surveyor General’s Office.

Endowment Fee

The Endowment Fee is a charge levied by the City off Harare, in terms of the Regional Town and County Planning Act [Chapter 29:12) 1996 (Section 41).

Per the Developer’s subdivision permit – the Endowment Levy is stipulated to be 10% of the value of residential stands per square meter, excluding the value of any improvements at the time of disposal. The Endowment Fee is payable by the Purchaser and payment of such is a pre-requisite of issuance of a Certificate of Compliance

The Sales Office is able to advise prospective purchasers of the Endowment Fee payable per individual Stand.

Public Lighting Fee

The Public Lighting Fee is levied by the City of Harare Department of Engineering Services and in terms of the Developer’s subdivision permit is stipulated at 5% of the cost of the development of public lighting.

The Developer is required to submit the public lighting designs to the Director of Works for consideration and approval and determination of the surcharge as stated above.

The Public Lighting Fees is payable by the Purchaser and payment of such is a pre-requisite of issuance of a Certificate of Compliance.

The Sales Office is able to advise prospective purchasers of the Public Lighting Fee payable per individual Stand.

Capital Gain Tax (CGT)

Be advised that With effect from the 1st January 2014, according to the Finance Act (No .2) of 2014, where a person transfers (cedes) to another person his or her rights in a residential, commercial or industrial stand, whether or not the stand is serviced and whether or not his or her title to the stand is registered under the Deeds Registries Act [Chapter 20:05], he or she shall be deemed to have sold a specified asset to that other person for an amount equal to the whole amount received by or accruing to him or her as a result of the transfer. The gains from such as a sale (Cession) of property rights shall be subject to a capital gains tax (hereinafter “CGT”).

CGT is determined to be 20 per cent (20%) of the capital gain, after the deduction of an inflationary allowance of 2.5% per annum on cost from the date of acquisition to the date of disposal, for assets acquired on or after 1 February 2009 and five per cent (5%) of the Gross Sale Proceeds for assets acquired prior to 1 February 2009 .

Cessionaries are advised to consider ZIMRA’s stance on the pricing of sale agreements for any related party transactions. Particular care should be taken when entering into any new Agreements in respect of Stands previously acquired under a Cession Agreement. Please note ZIMRA will require as a minimum, proof of payment of VAT by the Developer on the initial Sale and CGT related to all cession agreements entered into on or after 1 January 2014. The Developer recommends that prior to entering an agreement of Cession that the Parties independently seek the advice and guidance of ZIMRA.

The Developer will not be held responsible nor liable for any delays or additional costs on Transfer of Title relating to Cession Agreements entered into.